A prospective lender will see that you build credit steadily to show them that you can manage your finances responsibly. It is difficult to predict the time it will take to build credit. However, there are several factors which can impact the time taken to improve credit scores.

You can build credit right from scratch

When it comes to improving your credit score, there are many options. It is possible to improve your credit score by following a few simple strategies. These tips can help you build great credit and reap the rewards of higher credit limits, better interest rates, and credit card rewards. Although credit scoring can take some time and effort, it is possible for you to see improvement within a few months.

It is essential to build credit by establishing credit history. Establishing a credit history is the first step to building your credit score.

Opening new accounts

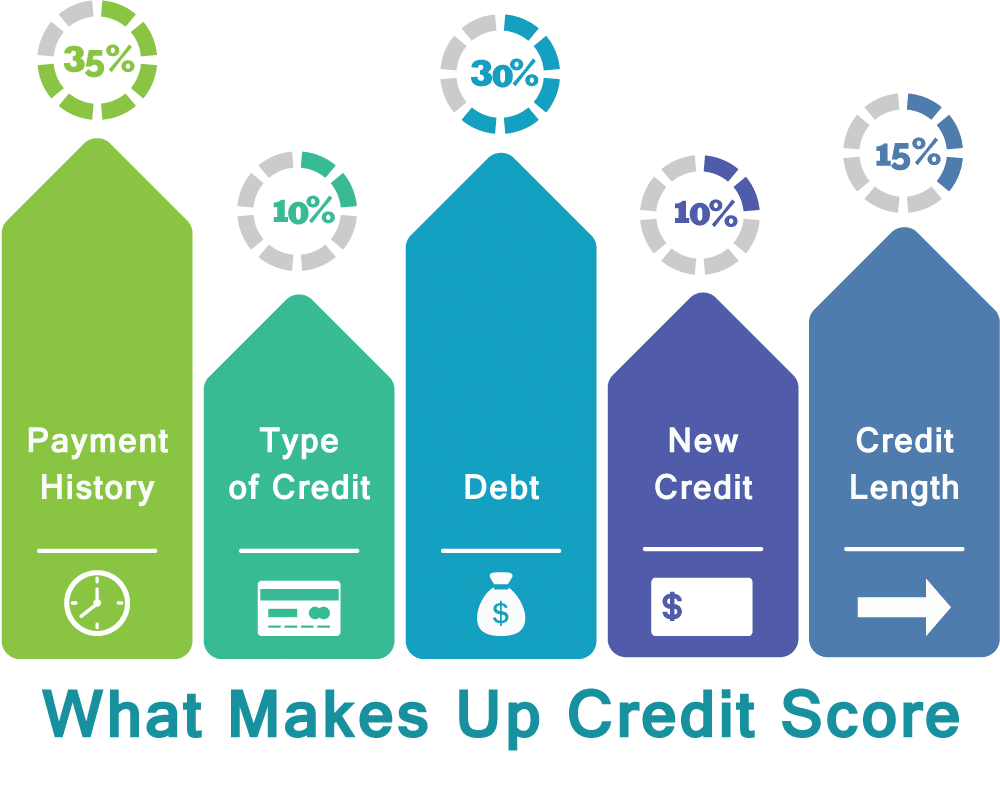

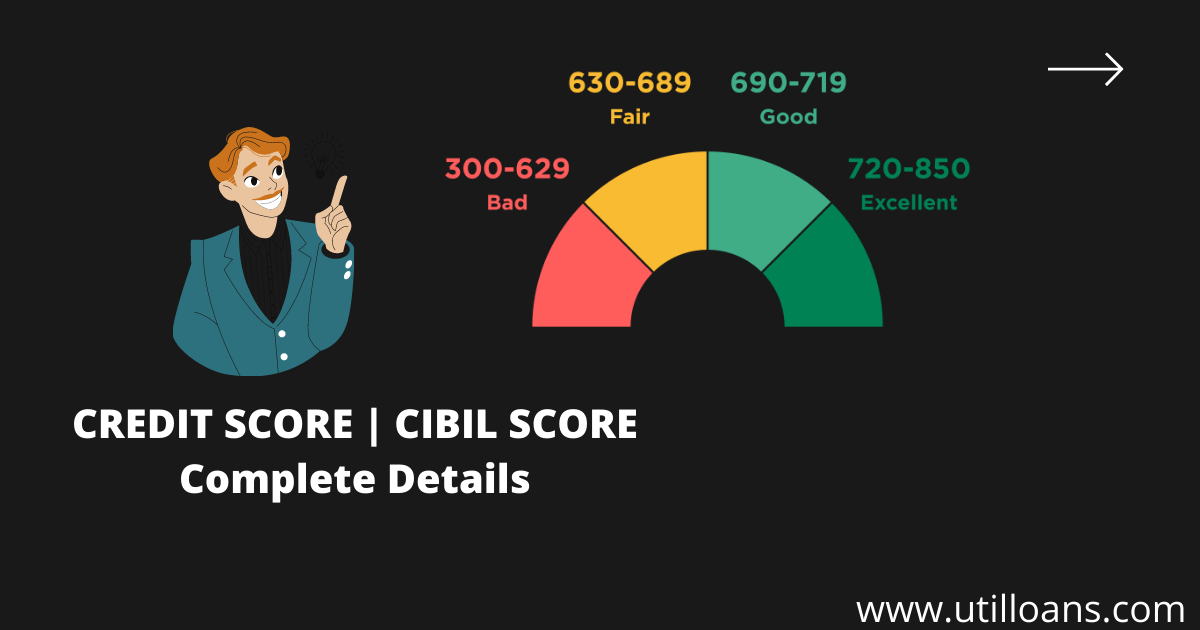

Credit score can be negatively affected by opening new credit accounts. Although it is temporary, this can have a lasting impact on your credit score for as long as a year. The type of credit score you have will affect the impact. However, generally speaking, opening a new account will reduce your score by 6-12 points. FICO credit scores are between 300 and 800. Most people fall between 600 - 750. Credit score can be negatively affected by opening new accounts, but it is possible to make positive changes if you make your monthly payments.

Limiting the number of accounts that you can open at one time is a good idea when applying to credit. While opening accounts with low balances may negatively impact your credit score for several months, it can lead to a significant improvement in your credit score. Start with smaller accounts and ensure that you manage them well for at least a year.

Payment history

It is essential to pay your bills in time to build a strong credit history. Your credit report will show missed payments and bankruptcies for up to seven years. It's important to pay your bills on time. By following these simple guidelines, you can quickly build up a great payment history.

The first step is to start paying off your delinquent accounts. You should catch up on any late payments and arrange to make your future payments on time. Your late payments won't be erased, but these payments will raise your overall payment history.

New credit utilization rate

Your credit utilization rate is one of the most important aspects of your credit score. If your credit utilization rate is low, lenders will be more likely to lend you money. You'll get higher rates and larger loans. There are many ways you can improve your credit utilization rate. The best way to reduce your credit utilization is to be as efficient as possible.

The credit utilization percentage is a number calculated by subtracting your current credit use from your total credit. If your credit utilization rate is less than 30%, you're on the right track. This number is significant because it can significantly increase your credit score.