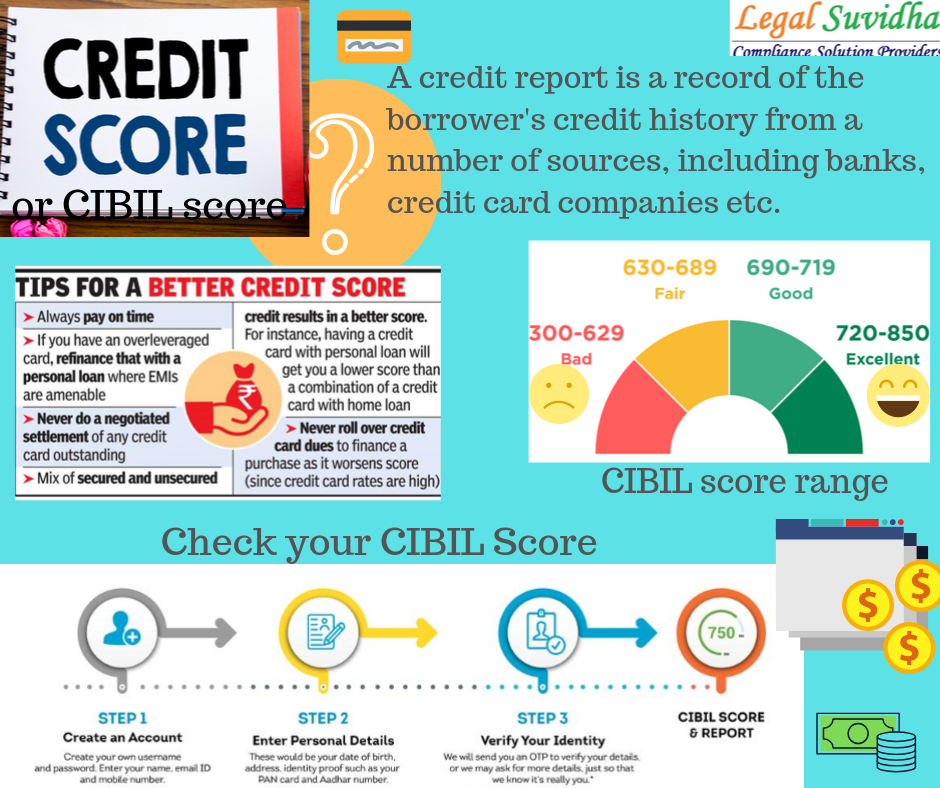

It is important to know your credit score before you make any purchases. You can do this by checking it at the three major credit bureaus Equifax TransUnion and Experian. You might find that your credit score is inaccurate if you only go to one bureau. You can have your credit rating lower if you provide incorrect information. It is therefore important to check your credit report with all three bureaus.

Equifax

Equifax credit information includes details about your credit history. It contains information about your credit history, including details of closed and open accounts, overdue debts and credit infringements. It can be used to help lenders determine if you are creditworthy. It can also show your employment history and length of residence. You score can also be affected based on the number of public records that you have, such bankruptcy or court judgments.

Your credit score should be raised as often as possible. Equifax has a number of packages that will help you raise your credit score. These packages can help you to protect your identity, track credit scores, fix financial problems, and time your applications. These services will save you time searching for credit information.

Lenders view a score of 750 as an excellent credit score. It is used by lenders to determine your eligibility for credit and set interest rates. By 2021, 46% of American consumers will have a credit score of 750 or higher. FICO, a credit reporting company, offers credit scores as well as insight into how to improve them.

TransUnion

TransUnion 750 credit score falls within the "good range". A good credit score is achievable, but not necessary to be able to qualify for the best deals. The right plan can help you improve your credit score. A good credit score will allow you to get better interest rates and offer flexible rewards.

Good credit scores are essential for getting the best rates, and best credit lines. You will not be granted a loan if you have a credit score below 750. When applying for a new loan or creditcard, the most important factors are your credit history and how much debt you have relative to income.

To maintain a good credit score, you should pay off credit card bills on time. Late payments can impact your score by as much as 23%. So, you should pay off your credit card debts on time. You can also improve your credit score by applying for a credit card with a low interest rate. But you must avoid behaviors that can lower your credit score.

Experian

An Experian Credit Score of 750 can refer to many things. A higher interest rate on new loans or refinances of older loans could all be possible. A higher credit score can mean more housing opportunities, as landlords will consider your credit history in deciding whether or not to rent. A high credit score is a valuable asset, especially in expensive housing markets.

A credit score of 750 is close to perfect. In fact, there aren't many things that need to change in order to join the elite club of individuals with scores of 800 and higher. To get a customized analysis of your credit, such as WalletHub, and to determine what needs to change, you can access a free tool called WalletHub.

A credit score of at least 750 is a great score. This score is above the 679 national average. However, even with this excellent score, you may not be able to qualify for the best rates or fees. Keep your debt ratio below 30% and make on-time payments to improve your score.