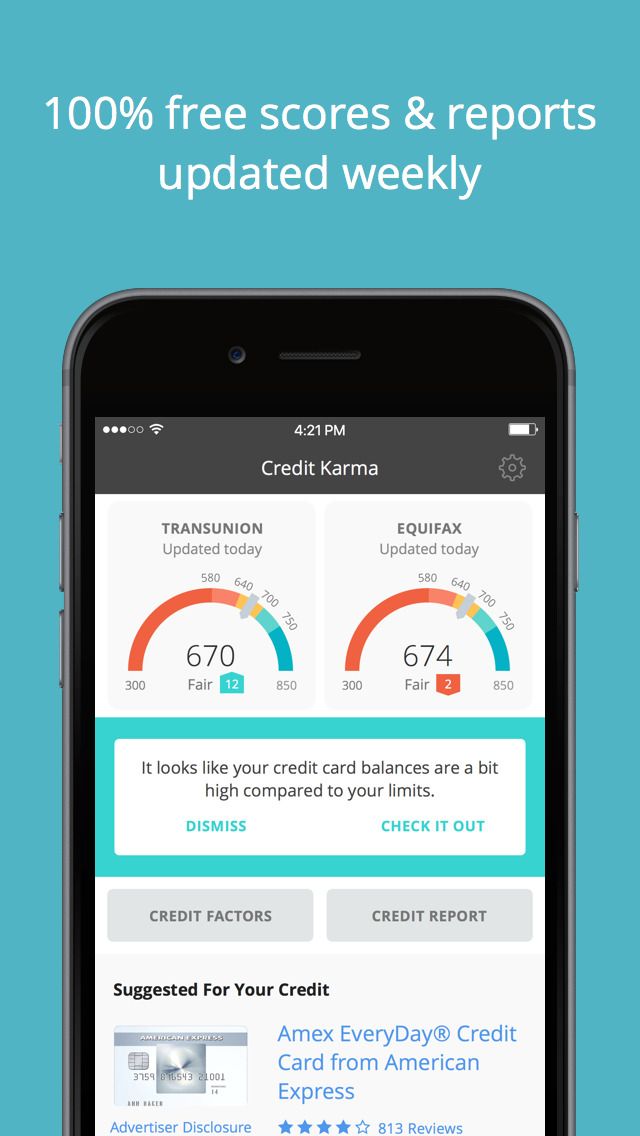

Before you close your credit card, it is important to review your credit history and see how it will change. Request your credit score free of cost from most issuers. There are also numerous websites that offer free credit scores. Although they may not be as precise as FICO scores, these scores can give you an indication of where your credit is at.

Close inactive credit cards or those that are not frequently used

Credit cards are a valuable financial tool. However, they may be no longer needed. Maybe they have high annual fees, high interest rates, or rewards that just aren't enough. It doesn't matter what the reason is, it is crucial to understand how closing them affects your credit score and how to deal with the change.

You can lower your FICO Score by closing a credit-card account. You should carefully consider whether closing an inactive credit card or one that is not used often is in your best interests. It won't help your credit score but it will reduce the temptation of making unnecessary charges.

You should first find a better way to use an inactive credit card. If the card is not used often, you might consider opening an online shopping bank. This will allow you to make small purchases each month and pay the card off before your next billing cycle. This strategy will help you keep your credit limit high while showing responsible credit usage.

Cancel cards that have an outstanding balance

First, contact the credit card company to cancel credit cards with outstanding balances. Customer service representatives should be able cancel your account. Be sure to verify that your account balance is zero before closing it. In this case, there may be residual interest. It may take a lot of effort and time to close an account.

Your credit report can take many months to reflect the cancellation. It doesn't matter how you cancel your card, you should get written confirmation from it. This will allow you to keep track of the date your account was closed. If you do not, you might be charged extra fees.

If you are unsure if you should cancel credit cards with outstanding balances, you can consult a financial adviser. Sometimes, canceling a credit card with a balance can be the best way to help a creditor who isn't able to pay.

Cancel cards with low balances before closing

Your credit card provider should be contacted before you close your account. You will need to inform your provider about your desire to cancel the account. Otherwise, residual interests will begin accruing after payment is made. You may also need to contact them to inquire about a new rate or reward program.

To cancel your creditcard account, contact the creditor and request written confirmation from them that the account balance has been $0 before closing it. Your credit report should be checked between 30-60 days after the account is closed. It should show that you've closed the account and the balance is $0, but if the balance is still listed, you'll need to open a dispute with the credit bureaus to have it removed from your credit report.

A joint credit card may be required if you go through a divorce, separation or other significant life change. This will help you keep from making purchases you'll regret later. A joint credit card can be used to help you pay off other debts if you are trying to manage debt.