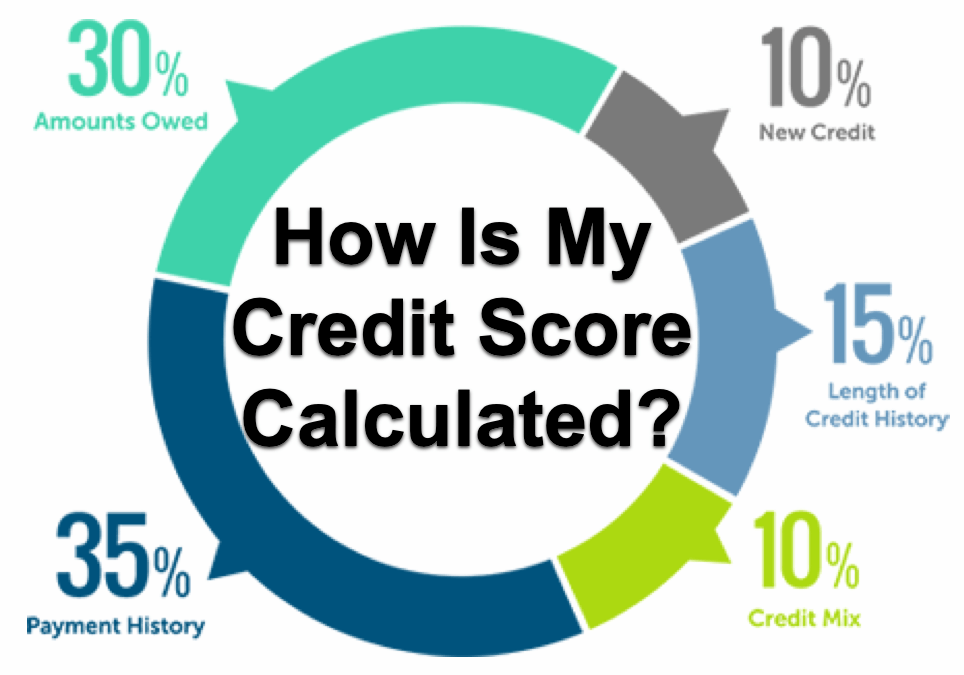

There are several factors that can influence your credit score. You can impact your credit score by the number of accounts you have with different lenders, the amount of debt that you have, as well as the type of credit that you have. There are some things you can do to improve your credit score.

Repayment of a loan

While paying off a loan with a high credit score can be beneficial, you need to know that it can also hurt your credit score. Your credit score will be affected by a variety of factors, including your credit history and amount owed. An average account age is around 15% of your overall credit score. So paying off an older balance on a loan is bad news for your credit. Low balance loans can also lead to lower credit scores.

Credit history length

A long credit history can help improve your credit score. This information is used by lenders to make credit decisions. Lenders are able to check if payments were made on time and assess if the borrower can be trusted. Lenders are more likely to lend to someone who has a long credit history, than to someone with one that is relatively new.

Debt amount

High credit scores can be hindered by excessive debt. However, it is important to understand that high debt is not automatically a sign of a high credit risk. If you manage your debt well, high levels of debt can be a good thing for your credit score. Recent research found that 36% said high debt does not negatively impact their credit scores as long as they are able to pay their bills on time.

Payment history

Credit score includes your payment history. This reflects your payment history, including whether or not you pay on time, when you missed them, and how recent you have missed one. Having a high payment history will raise your credit score. It's important to pay all accounts on time. It will increase your credit score if at least 90 per cent of your payments are made on time.

Credit score is affected by credit application

Multiple lines of credit can affect your credit score, such a credit card or credit card. Multiple applications can trigger hard inquiries that can hurt your credit score. It's better to apply for only one card and wait for approval. To build credit, you might also consider a personal loan over a credit card.

To improve your credit score, set up automatic payments

Setting up automatic payments is one of best ways to improve credit score. This allows you to keep up with your bills, and it also helps you avoid missing any. If you've paid your bills on-time, this can make a difference in your credit score. This can be a problem if you make a few late payments.