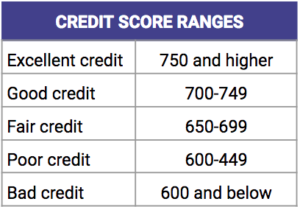

Personal loans are a risky move to help rebuild your credit. But it can make a difference in your credit score, if you manage the money well. Five factors are used to calculate a credit score. Each factor has a different weight. You can use this information to determine what you can afford and what types of loans might be best for you.

Car loans

Your credit score will be rebuilt if you make timely payments for your car loans. Your credit rebuilding efforts will be hampered if you make late payments. There are decent car loans available for rebuilding credit. Although it can be difficult for people with poor credit to find car loans at a reasonable interest rate, it is possible if they have good credit scores and a history in paying their bills.

Applicants with lower credit scores typically pay higher interest rates. So it is worth shopping around to get the best deal. Alternatively, you can postpone the purchase of a car until you have rebuilt your credit score and can qualify for a better rate.

Installment loans

Installment loans can be a great way to repair your credit score if you make the payments on time and maintain good financial habits. Your credit score will be boosted by these loans reporting every payment to the credit agencies. Late payments can cause serious credit scores to be lowered. If you don't make your monthly credit payments on time, then you need to find a new source of credit.

Lenders will often require that you have a minimum credit score in order to approve an installment loan. High credit scores will have a greater chance of repaying the loan. Some lenders will also consider your annual income in determining your interest-rate.

Payday loans

Payday Loans are great if your short-term financial crisis calls for extra funds. However, they can have a high interest rate and require payment within two weeks. These are not for the weak of heart. These items can actually end up costing you much more than you thought and can even cause credit damage.

Although payday loans are quick and easy to get, they can be very difficult to repay. These loans are not recommended for those who have to make large monthly repayments. Instead, choose an installment loan that requires fixed payments over a certain period of time. These loans are intended to make monthly payments easier and more predictable for people with poor credit.

Installment loans with cosigners

An installment loan can be arranged with co-signers for those who are trying to rebuild their credit. However, it is important to remember that defaulting on an installment loan will lower your credit score. Because lenders look at your credit history as a risk, they'll be less willing to give you the best loan terms. They may also take your collateral.

There are many options to co-sign for an installment loan. Most people who need a loan will ask a close family member or friend to sign on it. This commitment can endanger relationships and be very costly. It's a good idea, therefore, to find out more about loan options.

Fairstone personal loans

Fairstone offers personal loans for those with bad credit who need to rebuild their credit. There are more than 240 branches in Canada and they offer both secured and unsecured personal loans. A personal loan application is very simple. You can use your financial information, credit score, and other financial information to see if you are eligible for a loan.

While the application process may be lengthy, you can still complete it online. You can also send details and documents via email. While the application process is a bit lengthy, it is quicker than many other lenders. There are not many Fairstone personal loan reviews online, so it's hard to judge the company's customer service.