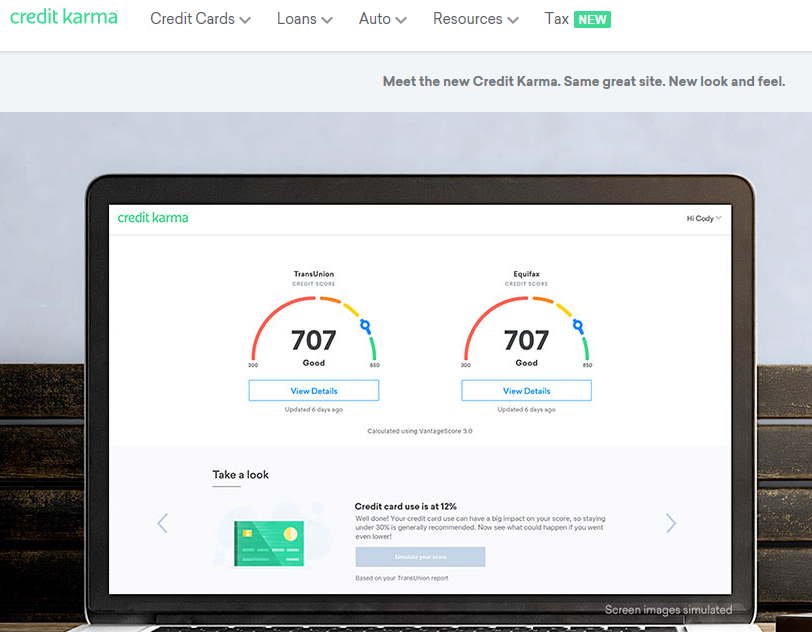

As long as you fulfill certain requirements, you can build credit at any age. FICO and VantageScore have no age requirements for credit scoring. It will be determined by your credit score and the minimum score you have. Credit scores do not start at zero. They can range from 300 to the lowest score possible, or up to a higher range depending on your credit file.

Your child can build credit by being an authorized user.

Most major credit card issuers allow children to become authorized users on their accounts. They must be 13 years or older. Adding a child to an account as an authorized user helps your child build their credit history and may improve rewards on the account. This can help your child build up credit as they grow up, which will make it easier for them to access money as they get older.

One of the best ways to jumpstart your child's credit history and build a positive credit score is to add your child as an authorized user on one of your own credit cards. This will improve their credit history because they will have a history of making on time payments. Your child's credit history will be based on how well you handle this account. If you have made late payments or have a high balance, it will negatively impact your child's credit score.

Secured credit cards can be a great way of building credit

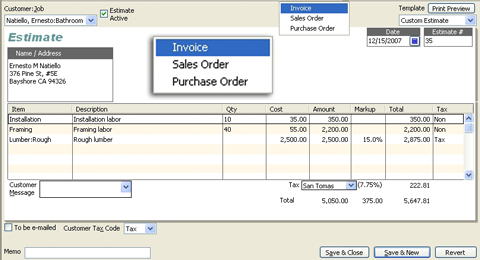

A secured credit card is a great way to get started in the credit world if you are new to it. These cards do not require a deposit, and you can report your payments to credit bureaus frequently. These cards will help you build your credit by teaching responsible spending habits. Inexperienced cardholders can benefit from secured cards, which typically have higher credit limits.

It is important to do your homework before you purchase a secured debit card. Be aware that these cards might have hidden fees and high costs. Secured credit cards are better if they don’t charge an annually fee, offer purchase security, and track your score. A secured card may offer cash back or rewards.

Another benefit of a secured credit card is the ease with which you can apply for it. Secured cards can report your payments directly to each of the three credit bureaus. This improves your credit score. Also, it is important to make your payments on time. Late payments can result in a reduction in your score. You should also keep your credit balances low, under 30% CUR. In a matter of months, your credit score should increase if you follow these guidelines.

Co-signing is risky when you are trying to build credit.

Both co-signers and borrowers are at risk from co-signing. Co-signing is a way to transfer your personal credit to someone else. It is not recommended for anyone less than 21. Many young adults do this for student loans. It is common for parents to co-sign the loan application.

It is risky to co-sign for a credit card. A co-signer who defaults on a credit-card transaction will be sold by the lender to a debt collection agency. This agency will then pursue the primary borrower, not the co-signer. The co-signer could file bankruptcy which can impact their payments obligations.

You can always add another authorized user to a credit-card account if you're unsure about whether cosigning is a good idea. You can establish your credit history by adding authorized users to your credit card account. However, you should be cautious about who you choose as your authorized user. You must ensure that they are able to repay any charges.