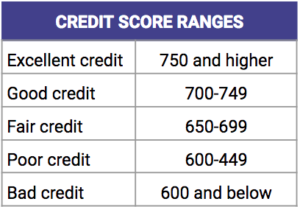

As long as you fulfill certain requirements, you can build credit at any age. FICO and VantageScore don't require you to be over 18 in order to qualify for most credit scoring companies. But it will depend on your current credit score and what minimum score you meet. Credit scores do not start at zero. They can range from 300 to the lowest score possible, or up to a higher range depending on your credit file.

Your child can get credit through an authorized user status

The majority of credit card companies allow children to use their accounts as authorized users. They must be at least 13 years of age. As an authorized user, adding a child to a bank account can help your child build credit and earn rewards. This will help your child build credit over time, which will allow them to access more money later in life.

One of the most effective ways to boost your child's credit and to build a positive credit rating is to add your child as an authorized credit card user. Because they have a history making timely payments, this will help improve their credit score. Your credit history will reflect how you manage the account. It will impact your credit score if you are late paying or have a high account balance.

Secured credit card are a great way build credit

A secured credit card is a great way to get started in the credit world if you are new to it. These cards don’t require any initial deposit. They also report your payments to the credit agencies regularly. These cards teach responsible spending habits and help build credit. Inexperienced cardholders can benefit from secured cards, which typically have higher credit limits.

Before you get a secured card, you should do some research. These cards may have hidden fees or high fees. Secured cards work best if they don’t have an annual fee, provide purchase protection, and keep track of your credit score. Consider a secured credit card that offers cash back or rewards.

Another benefit of a secured credit card is the ease with which you can apply for it. Secured cards can report your payments directly to each of the three credit bureaus. This improves your credit score. Your score will be affected if you don't pay your bills in time. Your credit balances should be kept below 30% CUR. If you follow these tips, you should see an increase in your credit score in a few months.

Co-signing is an insecure way to get credit.

Both the cosigner and borrower are at risk by cosigning. It involves placing your personal credit in another person's hands and is not recommended for anyone under 21. Most young adults do this to be able to borrow student loans. It is common for parents to co-sign the loan application.

Co-signing is a risky practice that may cause damage to your credit history and relationship. A co-signer who defaults on a credit-card transaction will be sold by the lender to a debt collection agency. This agency will then pursue the primary borrower, not the co-signer. Another risk is that the co-signer may file bankruptcy, which can affect their payment obligations.

If you are unsure of whether co-signing is a good idea, you can always add an authorized user to a credit card account. While authorized users can help you build your credit history without having to co-sign, be careful who you choose to be your authorized person. Be sure that they are able and able to pay any charges.