If you are trying to build credit, you should try getting a credit card. This card is great as it doesn't have an annual fee and reports to all three major credit reporting agencies monthly. This card is also available to those with no credit history or little credit. This card's biggest disadvantage is its high interest rate. It should be avoided if you are trying to increase credit lines. A number of credit cards are available that are suitable for people with bad credit.

Credit construction

You don't have long to build your credit. With the right card, you can earn points for having a great payment history and a low rate of credit utilization. If you frequently shop at stores, you can also opt for a store card. These cards are perfect for building your credit because they come with rewards and have lower interest rates than other cards. And if you're a college student, you can even get a student credit card. Be careful with building your credit. Otherwise, you could end up paying too much for what you don't need.

Getting a credit card

Credit cards can be a convenient way to purchase and help build credit. They should not be used for items that you cannot afford to purchase in cash, or that you don't need immediately. It is important to plan how you will pay your card's monthly balance and what fees are associated with it. A late payment fee of $29 is the national average. An over-limit fee of $39 can prove costly. If you are in the process of paying off your debt, you might want to stick to a debit card.

Making payments on time

Paying on time is the best way to improve credit scores. A single late payment can damage your credit for seven years. If you want to avoid late payments, your friends and family can lend money or take money from your savings accounts to pay your bills. Late payments can also affect your credit score. Credit scoring methods consider your credit limit as well as the balance of your cards. Your credit score will be better if you keep your balance at 30 percent or lower.

Don't increase your credit limit

Many cases allow you to increase your credit limit. However it is important that you request a limit at minimum twice your current credit limit. If your plan is to limit your credit, you could be denied. Be sure to review your spending habits and consider whether you can afford to increase your credit limit. This can lead to higher rates of interest, higher minimum payments and even higher fees.

Getting approved for a credit card

It is not always easy to get approved by a credit union that helps build your credit. This is because there are many factors that can make it difficult. It is unlikely that you will be approved if your job is not stable. You might even need to wait several weeks before you are approved. If you're patient, you can get approved. These are the steps you need to take to get approved.

Secured Credit Card

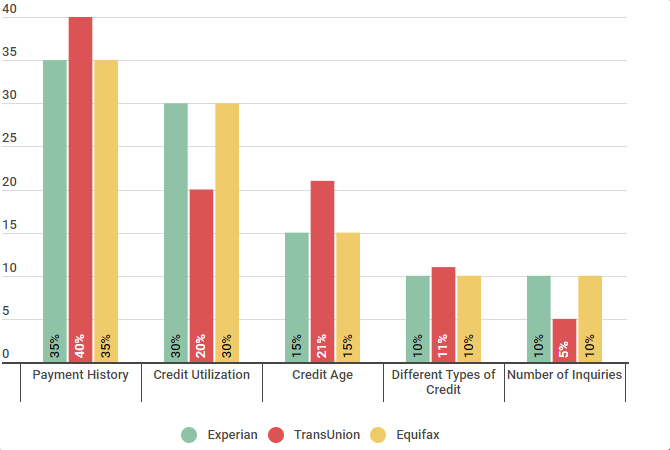

Using a secured credit card can help you build your credit score over time. Your credit card's utilization ratio is 35%. Therefore, if you keep your credit card balances below 10%, your score can increase. By making timely payments, your credit score will increase. Because time is your greatest friend with a credit card. You can build your credit score quickly with a secured creditcard.