A plastic credit card with full pay is not the same as one with a pay in full option. You should not carry cash around with you. If you stop using your credit card, your credit score is not affected. You can end up in debt if you use your credit card every chance you get. You have many choices.

The best way to go about it is to take a frank assessment of your current debts and set a budget. It is a smart idea to pay off any credit cards before you begin using them. Once you have a good handle on your spending habits you can look into debt consolidation. This will allow you to manage your budget effectively and leave you with some savings and retirement funds.

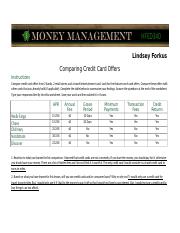

While you're at it, consider applying for a credit card with a lower interest rate. This will help you reduce your monthly payments, and also allow you to pay off your debt faster. This is one of your best options to protect your credit rating. Also, if your credit cards are stolen, you can cancel them and apply to get a replacement. Check out an online credit card specialist or reputable online retailer if you are in search of a new credit cards. Taking a few minutes to determine which type of card is right for you is well worth it. It will end up costing you a lot of cash to have a poor provider.