It can be hard to understand credit scores. There are two types. FICO is the most common and Vantage is the least. They are both completely free and come directly from different sources. VantageScores as well as FICO scores may have some differences. However, both are very important to know if you want to improve your score. This article will help answer the most frequently asked questions about credit scores. It will also help you understand how your score is calculated and how to maintain it.

Commonly asked questions about credit scores

Credit scores are used by lenders to determine if you are a good candidate for loan approval. Although each lender will have its own criteria, most lenders will consider scores between 700 and 800 to be acceptable. You will be eligible for the best interest rates if you have a score within this range.

Credit scores have an impact on everything. From loans to housing and employment, they can also affect your ability to get credit. Understanding them is essential if you want to reach your financial goals. These scores are calculated using information from your credit report and show lenders how likely you will be to repay a loan.

Credit score is based on factors

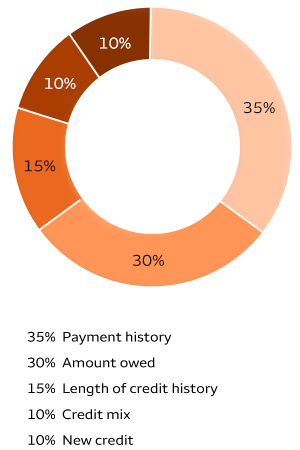

Credit scores can be affected by several factors. One factor that influences your credit score is your credit utilization ratio. This shows how much of your credit you use. This number is determined by your total debt and your available credit limit. It makes up 30% of your credit score. If you use more than 30% of your available credit, your credit score will be negatively affected.

Lenders use your credit score to determine how risky it is to lend you money. This includes auto dealers as well mortgage bankers, insurance companies and landlords. Credit card companies are also included. You can build and protect credit by understanding what factors impact it. Credit scoring companies use data from your credit reports to calculate your score, but they don't reveal their exact formulas. They will share some basic ingredients for calculating your score.

How to get credit

A credit score is a combination of several factors, such as the length of credit history and types of accounts. High utilization rates will harm your credit score. It's best to keep your accounts below 30%. Credit scoring models consider also the age and maturity of your accounts. Your score will increase if you have a mixture of older and newly opened accounts.

Understanding how credit scores are calculated is essential. A high credit score is a sign that you are less risky to lenders. Low credit scores can make it more difficult to obtain credit. It is therefore important to know your credit score.