The surge mastercard was designed for those with fair to poor credit. This card is reported to all three major credit agencies, so it can be used to repair and build credit.

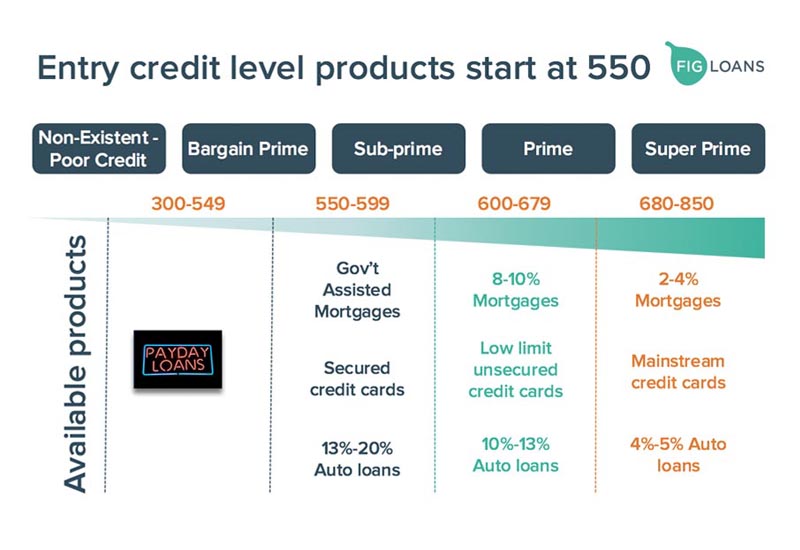

Getting a new credit can be difficult if your credit score is low. Many people with poor or low credit ratings are limited to secured card options that require large security deposits.

Other unsecured cards can be used to improve your credit score without requiring you to make a deposit. Surge Mastercard, a credit card from Celtic Bank, is an example of this type.

This card allows you to double your credit limit if you maintain your account for at least six months and practice responsible credit practices. In addition to that, you can get a monthly credit report to all three of the credit bureaus, and the card issuer performs automatic account reviews free of charge.

These features can improve your score and help you establish a good history of credit, which is essential to getting approved for loans like mortgages or car loans. Moreover, you can reduce your interest rate to make it easier for you to avoid becoming in debt.

You can also check to see if you're pre-qualified for this card before applying. This will help you to get an estimate of your borrowing capacity and the speed at which you can increase it.

Surge Mastercard is amongst the few unsecured cards which are easy to qualify and have high approval chances. The application process is online and easy to complete.

One of the benefits of this card is that it has a much higher credit limit than many other credit cards. Another advantage is that there's no security deposit required. These cards are perfect for those with bad or fair credit that have difficulty qualifying for unsecured cards.

This plan also has a lower monthly fee and an annual fee that is less. This means you can improve your credit score more quickly and get a better deal on your purchases.

This card will also help you increase your credit limit. It will boost your available credit, giving you greater purchasing power. The credit limit on this card ranges from $300 to $1000, depending on the credit history you have and your current credit usage.

Moreover, this card will report your on-time payments to all three of the major credit bureaus. These reports can help you increase your credit limit and get approved for more credit in the future.

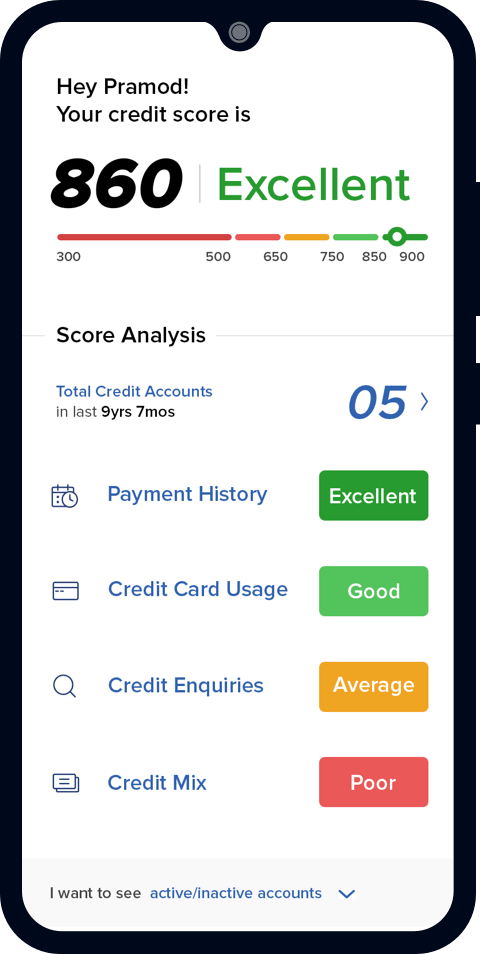

Surge Mastercard can help you improve your credit rating.

Surge Platinum Mastercard - Unsecured Credit Card can help you improve your credit rating. The card is not a reward card, but it does have an attractive APR and a low annual fee.

Surge Mastercard works best as part of your overall strategy to build your credit and should not be the only card you use. It can help you build your credit while helping you earn rewards and avoid fees, but you should be aware of the costs before you sign up.