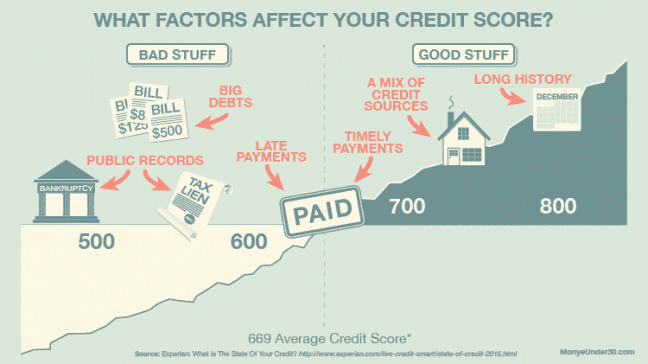

There are five major factors that affect your credit score. High scores can be obtained by disputing inaccurate information, and maintaining a clean credit record. It might take several years for your credit score to be repaired if there are many public records or delinquencies.

Score of 850 Credit

It may seem impossible to reach an 850 credit score, but it is very possible. According to an Experian survey, only 1% of Americans have scores of 850 or more. Maintaining a high score can be hard, but there are steps you can take that will help you improve it.

Requests for hard copies

Your credit score is affected by how many new applications you submit each year. These inquiries reflect your recent credit shopping activity and may be meaningful to a potential lender when assessing your credit worthiness. Multiple inquiries are generally considered one. But, this period of time varies between credit scoring models. This period allows you to compare loans and research them without negatively impacting credit scores.

Age

Building a strong credit history is a great way to improve your credit score. You can't instantly get to 850, but there are many things that you can do to increase your credit score. Your credit history should be reviewed. Age is one factor in determining your score. In their 20s, the average credit score is around 661. The 733 credit score is the best for this age group.

Income

The 850 credit score club has a higher average credit card balance than the overall population, with an average balance of $32,872 versus $17,064. It is important to remember that most members of this club are older. The highest percentages for 850-plus credit score holders are from the baby boomer and silent generations. Generation Z is only 25% of members of the 850+ FICO(r).

On-time payment of your bills

Payment history is a key factor in getting 850 credit scores. Your score will go up the longer your payment history. It is essential to make all payments on schedule and not carry any balance on any accounts. A clean payment record is essential for mortgage or loan approval.

Good financial habits

To improve your credit score, it is important to have a good financial record. A high credit score is a sign of your ability to manage both your credit card and your debt. People with high scores have long credit histories, perfect payment records, and a good balance between available credit and unpaid balances. They also only use a small portion of their credit limit. Because of this, they are considered less risky borrowers by lenders than those with lower credit scores.