If you want to improve your credit score, there are several things you can do. Your credit report should be reviewed. You should review your credit report to find any inaccuracies or signs of identity theft. Also, it is important to verify that any outstanding debts have been paid. Paying off old debts is a good idea if you have a lot of it.

Paying off debt instead of moving it around

You can improve your credit score by paying off all your debt. You have several options. You can also make additional monthly payments. The faster you pay your debt off, the more you can pay.

Collections repaid

There are several strategies that you can employ to get rid of debts you have sent to collections. If the collection is fraudulent or the agency doesn't have legal authority to collect the debt, you may try disputing it. Pay as much as you're able. These strategies can improve credit scores.

Revolving Debt Can be Paid Off

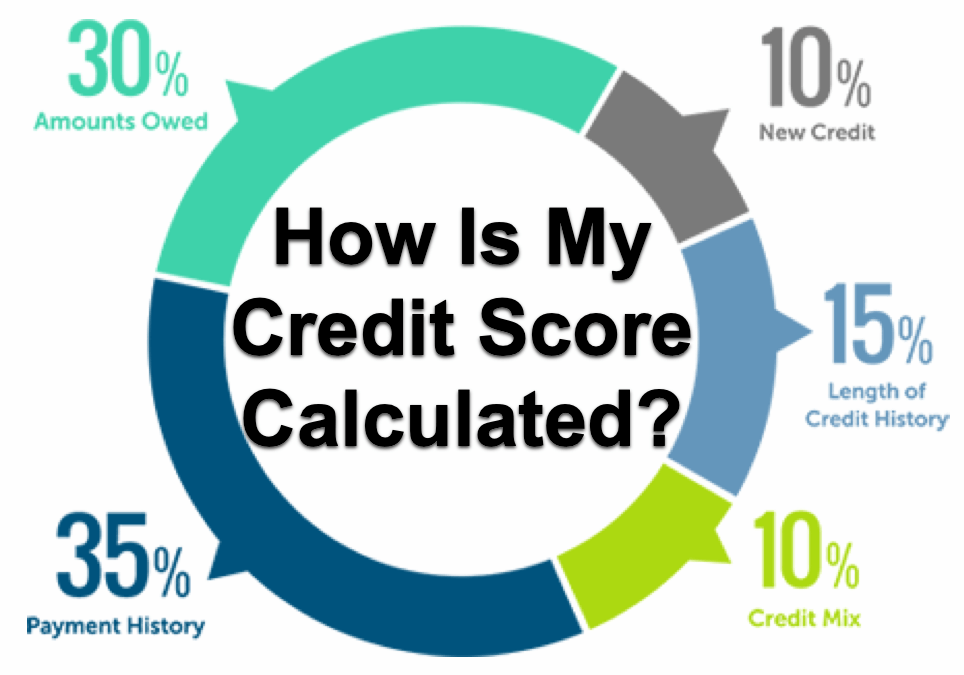

Paying off outstanding credit card debts is one of the best ways you can improve your credit score. Revolving debt has a greater impact on credit scores than installment loans. By paying off your debts you can save interest which can dramatically improve credit scores.

Restrictions on new accounts

Although it might sound counterintuitive at first, it is true that reducing the number of credit accounts on your credit report can improve your credit score. Limiting the number of new accounts you open is one way to achieve this. As a rule, the older the accounts, the better. Likewise, applying for new credit is not a good idea if you have recently lost your job or have had an income reduction.

Don't apply for quick loans.

You can improve your credit score by limiting the number of quick loans you apply for. Although quick loans are great for those who need cash quickly, they can also damage your credit score. Personal loans usually require a hard credit inquiry. This can affect your credit score by a few points. You will notice a greater impact if you apply multiple times for the same loan in a short amount of time.

Medical collections to be paid

You should first work out a payment plan to clear medical debt. You have two options: you can offer a lump sum payment or set up monthly payments that fit your budget. You will avoid negative comments on your credit score and credit report.