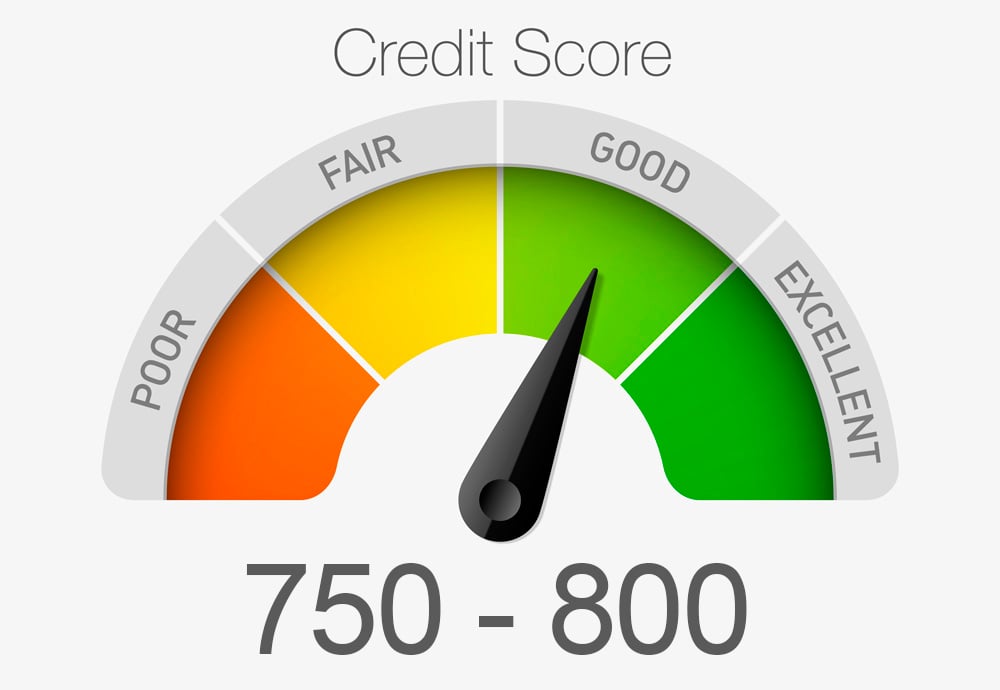

There is no difference in having a good or bad credit score. Experts say that the answer to what constitutes bad credit depends on how you use your credit. The five main credit categories that affect your credit score are payment history and amount owed, credit history, credit mix, and length of credit history. Each category makes up a portion of your total score.

Bad credit can have severe consequences

Poor credit can adversely affect your life and lead to many problems. A poor credit rating will make it more difficult for you get loans or credit from lenders. In addition, you'll need to pay higher interest rates. It will be more difficult to find work or rent an apartment if you have a low credit score. You will also have a harder time getting a car loan and may have difficulty getting utilities set up. Furthermore, you will likely face higher auto insurance rates and, in some states, higher health insurance rates. Potential employers will notice a poor credit rating.

There are ways to improve your credit rating. First, avoid opening up new lines credit. It's not recommended to open any new credit lines, but it is important to have a balance of different credit types. Keeping your credit mix diverse will show lenders that you can manage your finances.

Here are some ways to increase your credit score

One of the best ways to improve your credit score is by keeping up with your payments. Your credit score can be affected if you miss a payment. There are many things you can do in order to keep your payments on track. Credit scores are affected by many factors including how you pay your bills, how much credit you have used, and how much debt owe you.

A great way to increase your credit score is to keep your balances below 10% of your available credit. It is important to keep in mind that being close to your credit limit can reduce your score. It is better to pay your debt off immediately than transfer it to another credit card. Although it might seem counterintuitive, this is a good way to increase your credit score.

A good way to improve your credit score is not to open new credit accounts. A hard inquiry can be made to your credit report and could lower your score. Furthermore, opening new lines credit can decrease the length and importance of your credit history.

Getting a debt consolidation loan with bad credit

Bad credit can make it difficult to get a loan consolidation. However, there are ways to improve your credit score. In just six to twelve months, you can start to see improvements in your credit score. If you have poor credit, bankruptcy might be an option. But it should not be your last resort. An experienced credit counselor can help you decide if bankruptcy is right for you.

There are many different types of debt consolidation loan that you could apply for. Different lenders will require different credit scores. Most lenders require a minimum of 600 FICO. However, some will accept scores as low as 580. To ensure you get the best loan, it is crucial to keep track of your score. Numerous online tools and banks allow you to easily check your score.