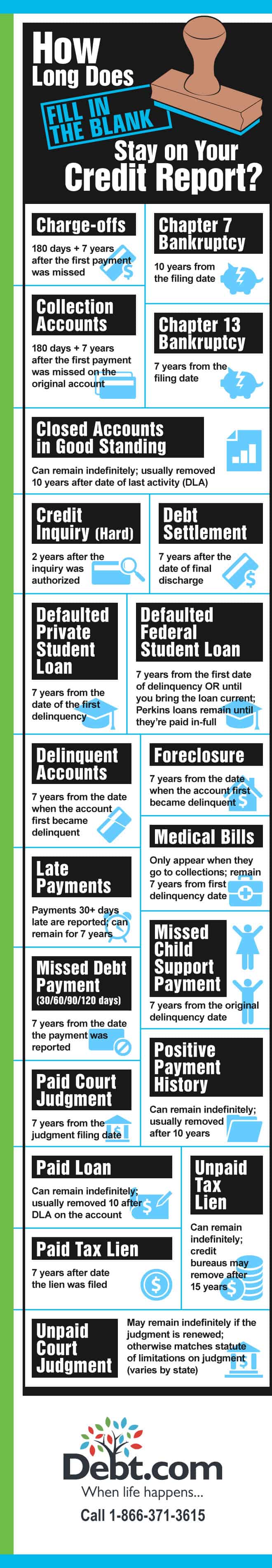

These are the five most important factors that can impact your credit score. High scores can be obtained by disputing inaccurate information, and maintaining a clean credit record. Repairing credit history with too many public records and delinquencies can take years.

850 credit score

Although it may seem impossible to achieve 850 credit scores, it is possible. According to an Experian survey, only 1% of Americans have scores of 850 or more. You don't have to be a pro at maintaining a high score. There are simple steps you could take to increase your score.

For more information, please contact us.

The number of applications that you submit every year has an effect on your credit score. These inquiries reflect your recent credit shopping activity and may be meaningful to a potential lender when assessing your credit worthiness. Multiple inquiries count generally as one. However, the time period varies depending on credit scoring models. This period allows you to compare loans and research them without negatively impacting credit scores.

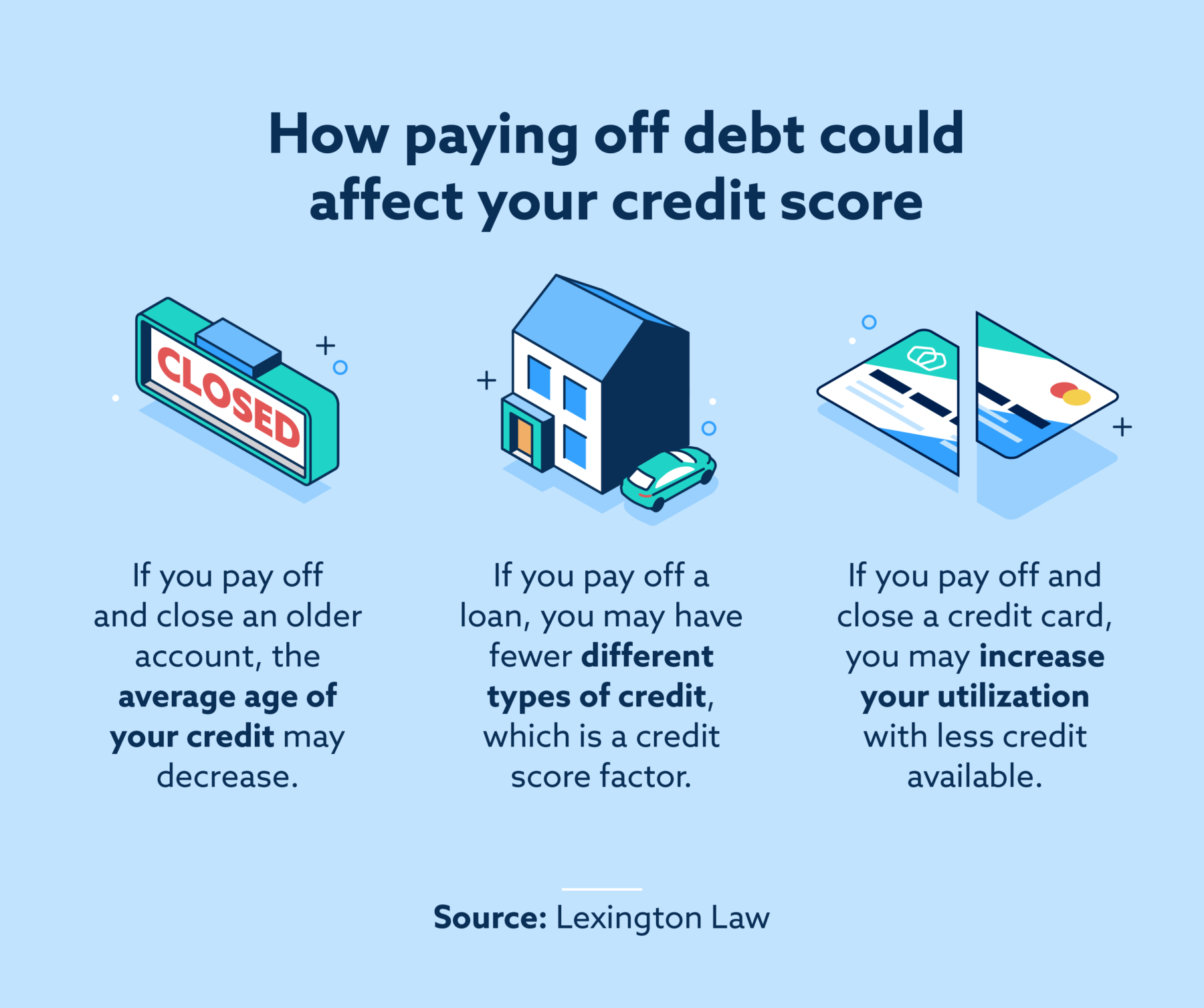

Age

Building a strong credit history is a great way to improve your credit score. You can't instantly get to 850, but there are many things that you can do to increase your credit score. First, you need to take the time and understand your credit history. Your credit score will be affected by your age. The average credit score of people in their twenties is around 660. People in this age bracket have the highest credit scores at 733.

Income

The average credit card balance for the 850 credit score club is higher than that of the general population. It averages $32,872 and $17,064. It is important to remember that most members of this club are older. The highest percentages for 850-plus credit score holders are from the baby boomer and silent generations. Generation Z is only 25% of members of the 850+ FICO(r).

Timely payment of bills

Paying history is one of your most important factors when achieving a credit score of 850. Your score will rise the longer you have a good payment record. It is essential to make all payments on schedule and not carry any balance on any accounts. It is crucial to have a good payment history in order to be approved for a loan.

A good financial practice

A good financial habits is one of the best ways to improve your credit score. A high score reflects your ability to manage your credit and your debt. People with high credit scores have excellent payment records, a long credit history and a balance between available credit balances and unpaid balances. These people also use only a small proportion of their credit limits. Lenders consider these borrowers to be less risky than borrowers with lower credit scores.