One of the most important aspects of maintaining good credit is knowing your credit score. Your credit score can be checked free of charge every four months, or once per year. FICO score reports are also available from many credit card companies. It is a good idea also to check your credit score at minimum three times per year.

Credit score can be affected with hard inquiries

Even though it may seem counterintuitive, hard inquiries can adversely impact your credit score. This is when a creditor asks for your credit reports. These inquiries are often the result of an error or identity theft, and you may not be aware of them until you notice a large number. Routine credit monitoring can help to identify errors. You can send a dispute correspondence to the credit bureau if you find an error. You can also contact your lender to dispute the inquiry and report fraud to the Federal Trade Commission.

Generally, a hard inquiry can lower your score by one to five points. The exact amount will depend largely on your credit score as well as the length of time since you last inquired. Avoid making too many inquiries unless absolutely necessary.

When determining your credit score the most important thing is to pay on time

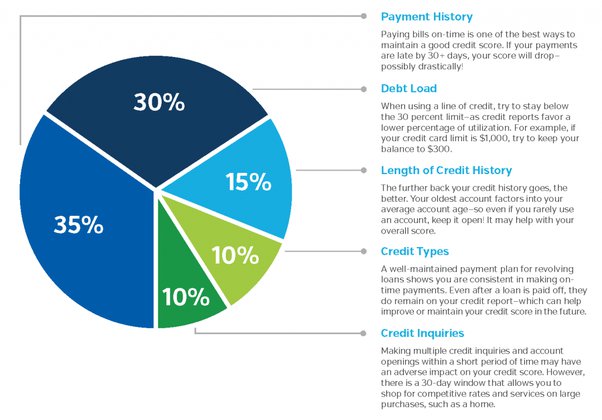

Paying your bills on time is a key factor in determining credit scores. This is because late payments can compound and make your debt difficult to pay off. Another factor is your credit utilization relative to your total debt. Lenders don’t like people with high credit balances. Therefore, it is crucial to keep your credit utilization at 30 percent. You can also improve your credit score by avoiding new credit cards and paying off those you have.

Your payment history is responsible for 35% your overall credit score. This will tell you whether you've made your payments on-time and how many times missed payments. This information is used by lenders to assess your ability to repay your debts on a timely basis. Late payments are bad news because they hurt your score, but if you have a long payment history, your score will be much higher.

Refute incorrect information on your credit reports

You can dispute incorrect credit information with credit bureaus if you believe it is. They will investigate the issue and give you a copy. The bureau may not accept your complaint and it will remain on your credit report. There are two options. You can either contact the creditor for clarification or re-dispute it with further information.

Writing a dispute letter is the best method to dispute inaccurate information. Include a dispute letter and copies of supporting documents. Your dispute letter should be sent to credit reporting companies using the address shown on your credit report. It should be sent by certified mail and accompanied with a return receipt.

False information on your credit reports can adversely impact your credit score. It can also affect your ability of borrowing money or getting credit cards. While the process is not difficult, it can be frustrating if the result isn't in your favor. But it's worth it if you can get an accurate report.